Appraising and Foreclosures in 2021

As an appraiser, are you ready to shift your business focus in 2021? While 2020 drove refinances by the truckloads, 2021 is likely to shift to an increased number of foreclosure appraisals.

Unemployment

Unemployment will likely worsen before it gets better. As a result, businesses continue to react to the consequences of Covid-related shutdowns and travel restrictions. Due to Covid, employment for millions of Americans will continue to change.

Data Peterson, chief economist for the Real Estate Forecast Summit Conference Board stated, “We won’t see the labor market go back to the 3.4% unemployment we had before the pandemic. It’ll probably level out around 5%. In normal times, that would be good. But based on how far we got in lowering the unemployment rate, that’s still quite elevated.”

The effects of rising unemployment will continue to domino throughout the economy. Unless legislation is signed that will extend the protections afforded underneath the CARES Act, by March of 2021, borrowers who signed up at the beginning of the program in March 2020 will be facing foreclosure. The expiration of the CARES Act will set off a mass exodus from homes. This exodus will flood the market with homes for sale. It will also curtail the availability of rentals.

Evictions & Foreclosures

To make the situation worse, the expiration of the ban on evictions that the Centers for Disease Control and Prevention decreed through December 2020 will increase the migration of homeowners and renters. Unemployment benefits are also nearing their expiration date. Unless legislation extends unemployment benefits, the situation will be even worse.

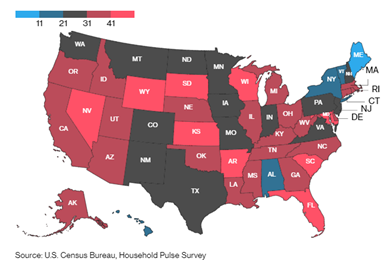

According to a survey conducted by the U.S. Census Bureau and completed on November 9, 2020, approximately 5.8 million adults say that they are somewhat to very likely to face eviction or foreclosure within the next two months. There are 17.8 million adults that live in households that are behind on rent or mortgage payments. That means that one third of these adults are facing eviction or foreclosure in the immediate future.

Shift Your Focus

The year 2021 is impossible to predict. However, as you can see, the signs indicate that there will be an increased number of foreclosure appraisals. Appraisers might need to shift their business focus to more foreclosure appraisals in 2021.

It is likely that refinancing will continue through 2021. Many homeowners have yet to take advantage of historically low interest rates. Refinances have slowed down in the last couple months of 2020 though. Keep up on the current trends and be prepared to make the shift in your appraisal focus as the market reacts to the consequences of Covid-19!

Looking for ideas on how to gain new clients? Check out our post: How to Make More Money as an Appraiser: Obtain New Clients.