Millennial Homebuyers in 2021

Millennials are Different Than Their Predecessors

Millennial homebuyers are the largest homebuying group in the United States. That makes it important for real estate professionals to understand this group and the impact they had on the 2020 real estate market and the impact they will have on the 2021 market!

After all, if you’re in one of the older generations (the often ignored Gen X; the second-largest home-buying group, the Baby Boomers; the Greatest Generation; or the Silent Generation) you have likely noticed a difference in your business interactions with Millennials as a whole. As appraiser Keven Ewell said about Millennials,

Setting up appointments with Millennials is different. They don’t answer their phones. They use text most of the time and rarely answer emails.

So rather than wishing Millennials would behave like their older and more experienced generations, the older generations should learn how to work with this large, influential group!

Even if you are a Millennial, you still want to understand your cohorts! Understanding the nuances of a group generates ideas for more effective techniques that allow for successful transactions despite generational differences.

Let’s dig into the Millennial homebuyer history of 2020 and see what insights we can find. The more we learn, the more comfortable and successful we will be working with the Millennial!

How Many Millennial Homebuyers Were There in 2020?

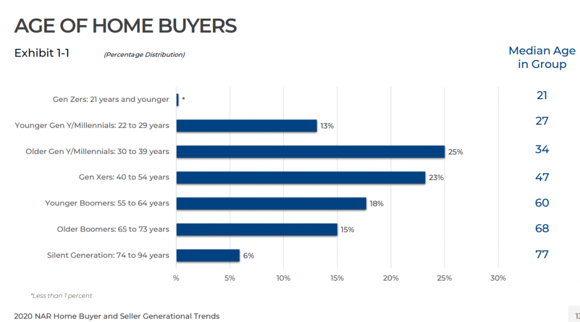

First, let’s clarify which age groups I’m talking about when I say “Millennial,” or “Gen X,” etc. This chart shows the breakdown of the different age groups with their corresponding moniker.

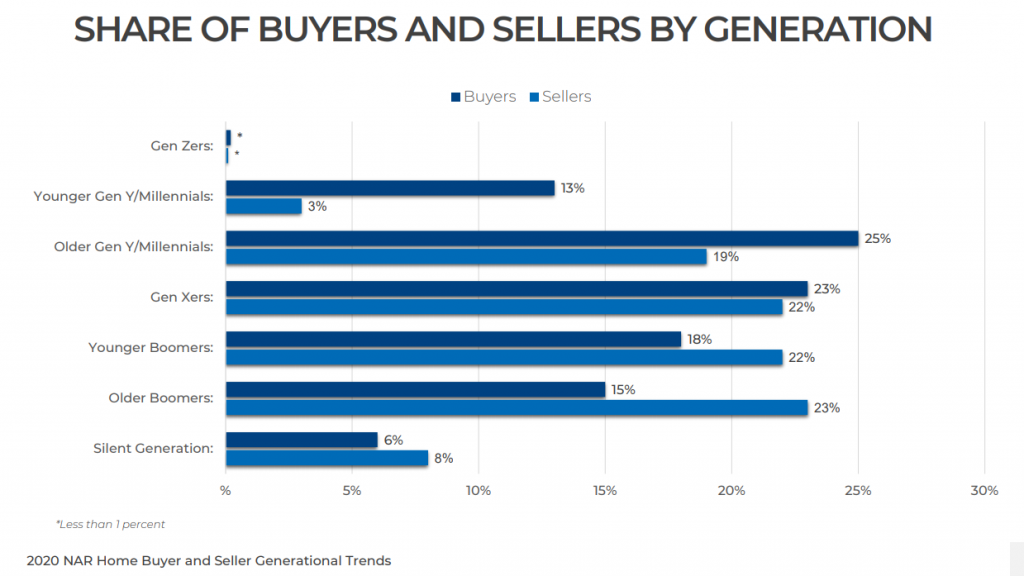

The booming real estate market in 2020 solidified the rise of the Millennials. Millennials accounted for about 38 percent of all home purchases in 2020. The Baby Boomers weren’t too far behind at 33 percent, with Generation X much further behind at 23 percent, and the Silent Generation at 6 percent. Clearly, the Millennials are the driving force behind the current home buying market.

Want to see that info in chart form? This chart shows the percentage of total home purchases made by each age group.

How Do Millennials Afford Homes?

What are Millennials facing as they save to purchase their first home or upgrade to a second home? Homes in the United States aren’t getting cheaper! In the last year their price tags have jumped to levels that worry first-time buyers and would-be upgraders.

In 2020, median home sale price increased 15% year over year to $318,750. This jump hasn’t lowered the percentage of home ownership in the United States though. Percentage of homes which are occupied by their owners was 65.8% in 2020. This rate has stayed relatively consistent since 1960, with homeownership bouncing between the 61-to 65-percent range.

While homeownership rates aren’t dropping as a whole, however, they are dropping among young adults! Between 2010 and 2017, homeownership rates increased only among adults aged 65 and older. Rates for adults 20 to 64 dropped by 3 percent!

Historically, the younger generation has had a lower level of home ownership, however the distance between the younger and older generation homeownership rates has increased! From a 25 percentage-point difference in 1960 to 44 percentage-points in 2017, the difference continues to grow!

It’s no surprise that young generations are struggling to afford homes. The heavy debt burden of owning a home is becoming too much for too many Americans!

To understand what factors influence the ability of the Millennials to afford their first home or a repurchase, let’s look at the factors affecting their age group in particular.

Education

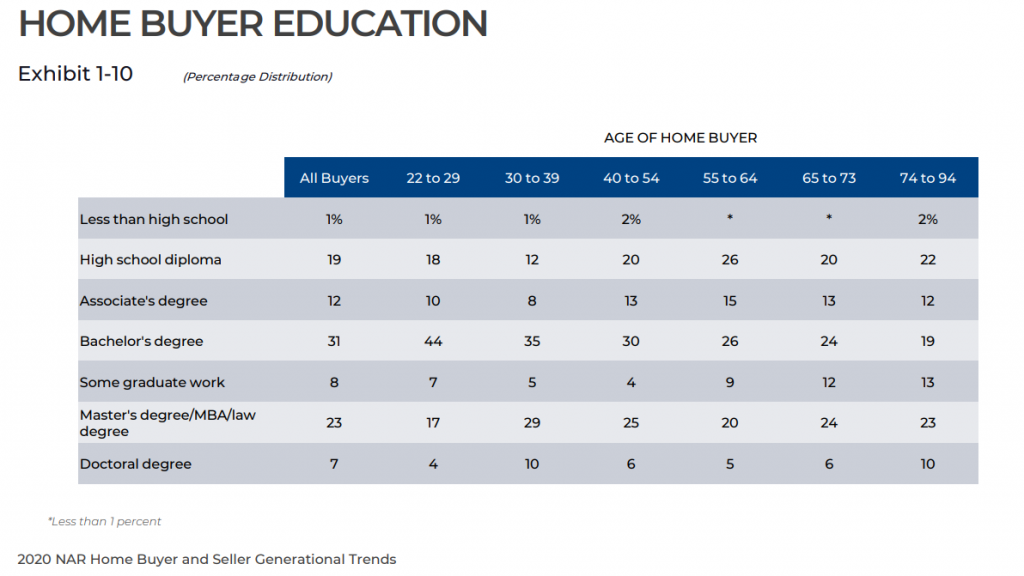

Eighty-one percent of all home buyers have bachelor degrees or higher with similar numbers in the Millennials group. College recruiters surely love this, making it a very convincing reason to get a bachelor’s degree or higher!

A high school diploma or associates degree didn’t stop 28 percent of Younger Millennials and 20 percent of Older Millennials from buying a house though. And one benefit of no college degree, less or no student loan debt!

Student Loan Debt

With college degrees comes lingering debt for almost half of all graduates. Millennials carry a heavy burden of the cost of an American education. Forty-six percent of Younger Millennials reported student loan debt with a median loan balance of $26,000 compared to 38 percent of Older Millennials with a median of $34,000. Only 23 percent of buyers 40-54 had student loan debt with a median balance of $30,000.

This presents a dilemma. Earning a bachelor’s degree or higher gives a statistically higher chance of owning a home. However, with the degree comes debt (at least for 56 percent of all students), and with debt comes a difficult time in buying a first home or upgrading as circumstances change. How to balance this? As Millennials age, their earnings usually increase!

Income

Income obviously plays the biggest role in the ability to buy a home. The median household income of first-time buyers in 2020 was $80,000, up from $68,703 in 2019. (And just a little tidbit, the median age for first-time buyers was 33.)

Buyers between 40-54 had a median household income of $110,900, and buyers 30-39 had a median income of $102,800. With the national median household income at $68,400, it’s a wonder that many are able to afford a home at all. The debt load is becoming unsustainable for many.

The rise in home prices is pushing out lower-income earners. As Lawrence Yun, NAR chief economist said,

Unless the housing supply increases, the future of home ownership for young adults is bleak.

Inventory

Not only do Millennials homebuyers have to figure out how to afford a home, they also have to deal with the sorry state of inventory! We’ve all seen the memes about the extremely low inventory in the housing market in 2021. There isn’t one factor that by itself explains the slim pickings. Multiple factors are contributing to this drought. Let’s examine the culprits!

Finding Another Home

According to Redfin chief economist Daryl Fairweather, Home owners are more reluctant to sell because it will be difficult for them to find another home! Unless they’re moving to an area where homes are cheaper and the home owner can afford to outbid other buyers, it’s not worth the hassle! At this point, many home owners are content to stay settled in their equity-sprouting home and wait out the meteoric rise in rates!

Covid-19

Covid-19. So much can be said about Covid-19! The pandemic has affected the housing industry in a myriad of ways.

Savings

Changes have occurred in work, travel, and social habits during the pandemic. According to a survey of 2,000 millennials by realtor.com, 75 percent said that they had been working remotely since the pandemic began! It comes as no surprise then, that being stuck in a small apartment or home became more and more unappealing. As Millennials spent most of their time during the lockdown in small spaces, they began to take notice of more livable locations. Properties in the suburbs with more room to stretch have become hot commodities.

Many of the 2,000 Millennials surveyed were planning on moving. Sixty-eight percent of those surveyed said they had saved more for a down payment while sheltering in place!

Interest Rates in 2021

Interest rates have been another driving factor behind the low inventory. With rates predicted to rise slightly this year to an average of 3.1 percent, the rise in home prices will likely slow, although they are predicted to continue rising!

First-time Buyer Credit

Many first-time buyers are excited for the proposed $15,000 tax credit for first-time homebuyers. While this credit will help first-time home buyers, there must be inventory for the first-timers to buy! As the construction market begins to pick up speed this year (see the next section on new home construction) and interest rates rise, perhaps the next few years will see a leveling of the housing shortage.

New Home Construction

Coming into 2020, there was already a shortage of 2.5 million units, according to research by Freddie Mac. The pandemic didn’t help, and due to a mix of the high cost of home-building materials, the limited number of lots, costly permits, supply-chain issues, restrictive zoning laws, and a skilled labor deficit, new home construction was unable to take much of a bite out of the elephantine inventory deficit.

New home construction permits rose by 22.5 percent year over year and 10.4 percent month over month in January of this year. While housing starts fell slightly year over year (2.3 percent), housing completions rose 2.4 percent year over year. The hope, of course, is that by the end of 2021 there will be a hefty dent in the housing shortage.

Working With Millennials Homebuyers

Millennials (and all other first-time home buyers) are facing significant obstacles as they enter the home market. Many are choosing to wait out the market in the hopes that prices will settle and inventory will rise. Yet many Millennials are still choosing to build or buy. As a real estate professional, you will certainly work with many buyers from this generation.

I’ve touched on many of the factors influencing Millennial homebuyers today. You’ll certainly run into other factors as well. Understanding the whys of generations as a whole is helpful for all of us as we move into the future. Good luck on working successfully with the up and coming generations!